- Home

- |

- Investments

- |

- Understanding managed funds

What is a managed fund?

A managed fund is a vehicle that pools the money of many investors to create a diversified portfolio. An investment manager buys and sells assets on behalf of the investors; individual investors own units in the fund, and the unit price is directly linked to the value of the underlying portfolio.

Managed funds enable you to select an investment that matches your objectives, but leave the day-to-day management of the investment to a professional.

Managed funds are run in accordance with their investment policy, which mandates which asset classes, geographies and sectors the fund manager may invest in; funds can only invest within the stated bounds, so you can feel confident in the type of assets the fund you select will invest in.

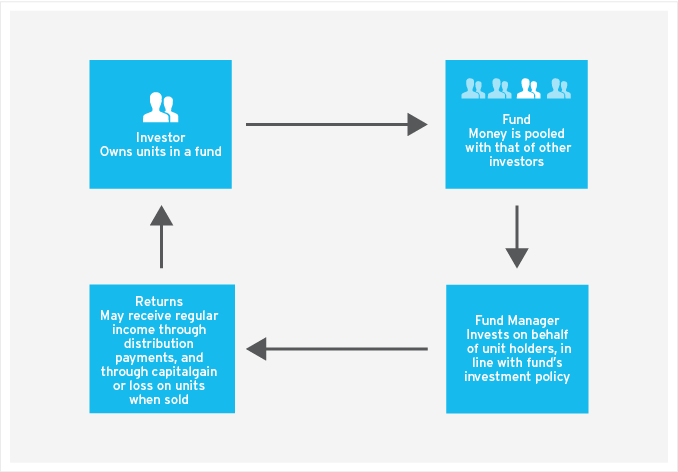

How do managed funds work?

When you invest in a managed fund, you are buying units or shares that represent your interest in the fund. In Australia, most managed funds are set up as unit trusts, in which the ownership stake for each investor is represented by the number of units held.

The money of many unitholders is pooled together and used to purchase investments that are in line with the fund’s investment policy. Most funds are actively managed, meaning the fund manager is constantly monitoring the fund’s investments, and buying and selling the underlying assets in line with their expectation of market movement, in order to maximise your returns.

The value of units will change in line with the value of the fund’s underlying investments, and so each unitholder participates proportionately in the gain or loss. Unitholders may receive:

What do managed funds invest in?

One of the most important things to remember about managed funds is that they are simply an investment vehicle; each fund will invest in different assets, and the commonality between all managed funds is that their composition is determined by the fund’s investment policy.

This means that investors are able to choose from a wide array of managed funds, ranging from highly-specialised through to general. The investment policy of managed funds is often based around one or more of:

It is important to note that not all funds are actively managed – you can also invest in passive funds that mimic the composition of a specified investment index.

Any advice is general advice only. It was prepared without taking into account your objectives, financial situation, or needs. Before acting on this advice you should consider if it's appropriate for your particular circumstances. You should also obtain and consider the relevant Product Disclosure Statement and terms and conditions before you make a decision about any financial product, and consider if it’s suitable for your objectives, financial situation, or needs. Investors are advised to obtain independent legal, financial, and taxation advice prior to investing.

Investments are not deposits or other obligations of, guaranteed, or insured by Citibank N.A., Citigroup Inc., or any of their affiliates or subsidiaries, or by any local government or insurance agency, and are subject to investment risk, including the possible loss of the principal amount invested.

Investors investing in funds denominated in non-local currency should be aware of the risk of exchange rate fluctuations that may cause a loss of principal. Past performance is not an indicator of future performance. Investment products are not available to US people and may not be available in all jurisdictions. All investments are subject to risks and can change in value.

© 2019 Citigroup Pty Limited ABN 00 004 325 080, AFSL No.238098, Australian credit licence 238098. Citibank®, Arc Design® and Citi Simplicity® are service marks of Citigroup Inc.