- Home

- |

- Investments

- |

- Understanding structured Investments

What is a structured product?

A structured product is an investment vehicle that allows an investor to purchase a single instrument, gaining exposure to a range of underlying assets.

The result is a customised investment that is designed to either reduce exposure to falls, while retaining potential for returns, or to maximise the benefit from a flat or rising market.

How do structured products work?

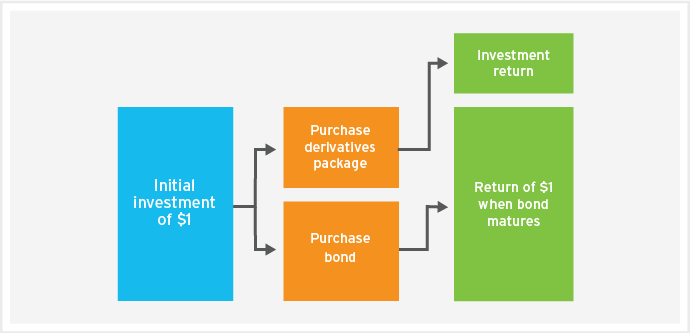

When you buy a structured product, you are buying an investment vehicle whose underlying assets can be customised to suit the desired return profile and can provide either income, capital growth or a combination of both.

By virtue of this customisation, each structured product will have unique underlying assets. However, the majority will combine multiple underlying investments, most often:

This combination of bonds and derivatives can be structured to provide either a fixed or variable return for the investor, which may be received as cash, or transferred as instruments (such as shares) to the structured note holder at maturity.

Any advice is general advice only. It was prepared without taking into account your objectives, financial situation, or needs. Before acting on this advice you should consider if it's appropriate for your particular circumstances. You should also obtain and consider the relevant Product Disclosure Statement and terms and conditions before you make a decision about any financial product, and consider if it’s suitable for your objectives, financial situation, or needs. Investors are advised to obtain independent legal, financial, and taxation advice prior to investing.

Investments are not deposits or other obligations of, guaranteed, or insured by Citibank N.A., Citigroup Inc., or any of their affiliates or subsidiaries, or by any local government or insurance agency, and are subject to investment risk, including the possible loss of the principal amount invested. Investors investing in funds denominated in non-local currency should be aware of the risk of exchange rate fluctuations that may cause a loss of principal. Past performance is not an indicator of future performance. Investment products are not available to US people and may not be available in all jurisdictions. All investments are subject to risks and can change in value.

Structured products are complex products. You should refer to the Product Disclosure Statement for a full list of risks before making an investment decision.

Investment product. Not a deposit. No bank guarantee. No government guarantee. May lose value.